Investing In Eternity

ENDOWMENTS CHANGE LIVES!

Southern Adventist University operates through the grace of Jesus Christ and His blessing on private gifts, tuition, business income, and earnings from our endowment. The endowment primarily supports $2M in scholarship for students each calendar year. Its established base and predictable year-over-year earnings mean that Southern’s scholarship awards can remain consistent each year.

Amount of Endowed Scholarships Awarded Last Year

Total Endowment Value

Total Number of Individual Funds In Endowment

Looking Forward

Rhonda Champion, '82, shares her experience as a business student at Southern Adventist University and why she established the Looking Forward Endowed Scholarship to help ensure current students will enjoy similar blessings.

common endowment questions

What Is An Endowment?

As a result of compounding interest, an endowment not only pays out funds each year but also continues to grow the endowment's base amount. For example, let's assume a scholarship endowment was established with a gift of $25,000. Over the past 10 years, that one gift would have provided $12,000 in scholarship funding while the gift value would have also grown to $30,000.

Each individual established endowment–Southern has just under 300 individual, named endowments–combines to make the university’s overall endowment, which totals around $60M. Because the university is tax-exempt, the endowment is also exempt, allowing for all earnings to directly benefit the university and its students.

why are endowments important?

A healthy endowment also provides financial stability that boosts confidence for lenders and creates a buffer against insolvency. Endowments are very tested and proven earning vehicles, especially for institutions of higher education with varying values from a few million to several billion.

what do endowments support?

how is southern's endowment managed?

what about Endowment Reporting and Transparency?

How and Where Are Endowment Funds Invested?

Do Endowments Have Constraints or Restrictions?

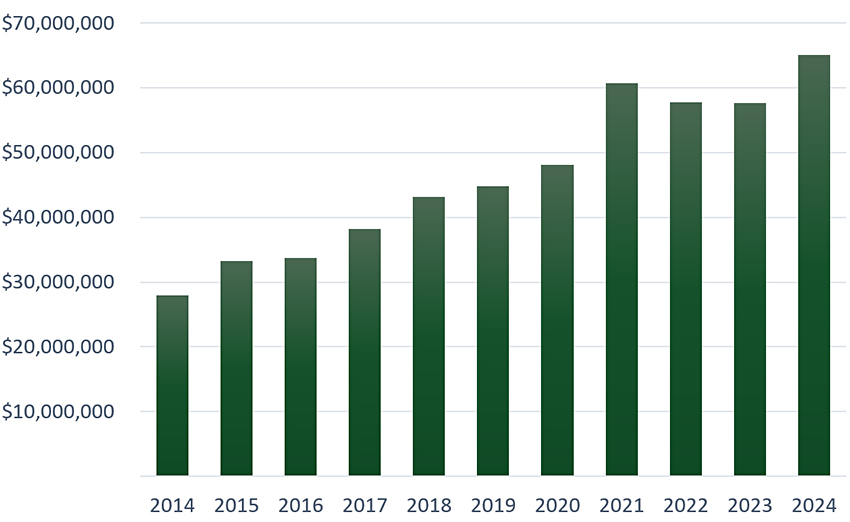

Endowment Value History

anyone can start an endowment – even you!

Click on the three flip cards below to learn more.

+ why name an endowment?

Southern has many named endowments, named for the donors themselves or for people those donors sought to honor. While certainly not required, a named endowment reminds the recipient of those endowment earnings that philanthropy helps support Christian education. A student who receives a named endowment is appreciative of the person helping him or her and feels inspired to pay it forward when given the opportunity.

See Examples

+ the power of endowment

Endowments are powerful, because they support causes the donor cares about in perpetuity. Endowments are also powerful because of their ability to outgive their principal. A $25,000 endowment will generate approximately 9% interest each year, market conditions notwithstanding. Within 12 years, it will be generating annual interest earnings that exceed the original $25,000 investment!

See Examples

+ Ways to Start

There are three ways to begin an endowment at Southern: 1) an outright, one-time gift, such as cash, stock, IRA, or DAF; 2) a gift pledge over time, usually five years or less and paid annually; and 3) a deferred gift in your estate plan. Southern’s minimum gift level to begin an endowment is $25,000. This means that you could begin an endowment at Southern with as little as $5,000 each year given to the endowment over five years.

See Examples